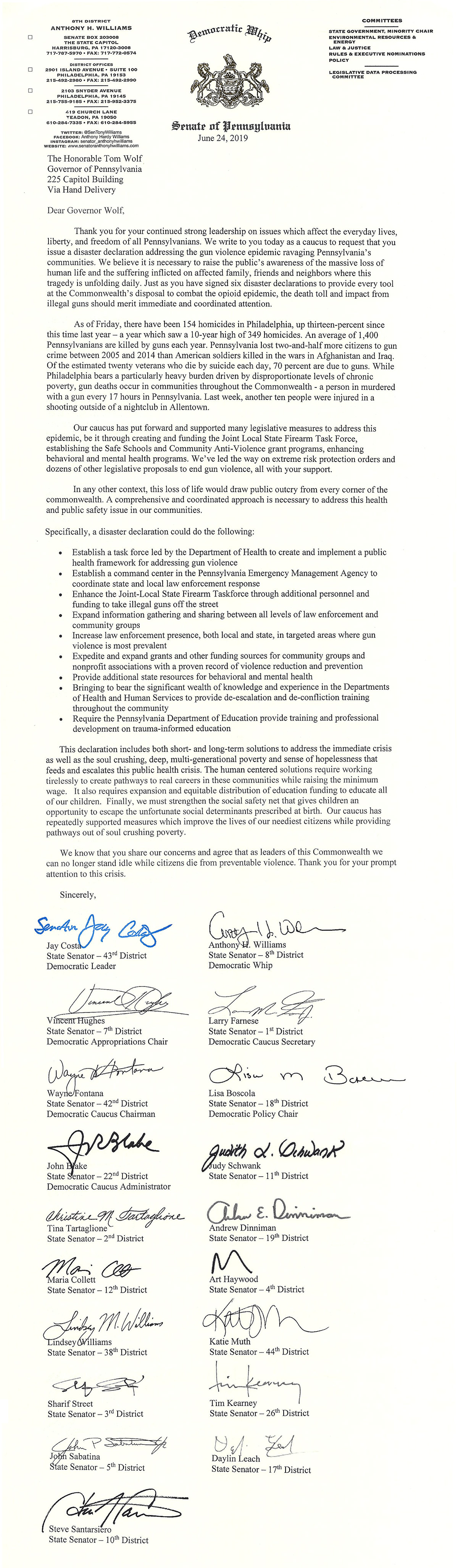

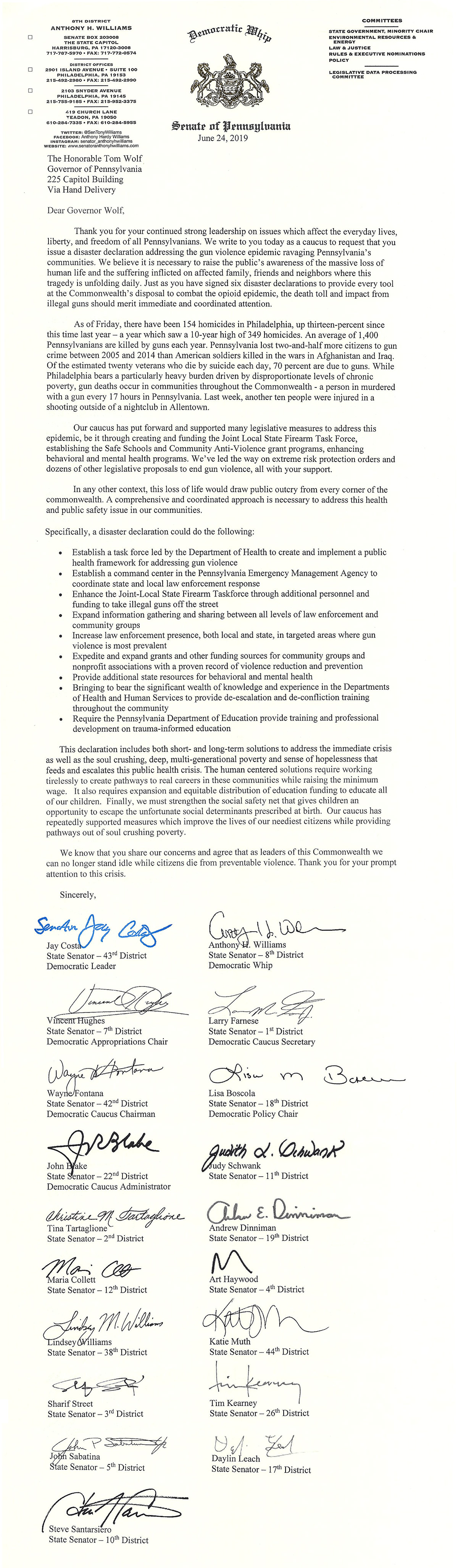

Harrisburg, Pa. − June 24, 2019 − Members of the Pennsylvania Senate Democratic Caucus today jointly sent a letter to Governor Tom Wolf requesting a disaster declaration for gun violence in the Commonwealth.

“We believe it is necessary to raise the public’s awareness of the massive loss of human life and the suffering inflicted on affected family, friends and neighbors where this tragedy is unfolding daily,” they wrote. “Just as you have signed six disaster declarations to provide every tool at the Commonwealth’s disposal to combat the opioid epidemic, the death toll and impact from illegal guns should merit immediate and coordinated attention.”

Specifically, a disaster declaration could do the following:

- Establish a task force led by the Department of Health to create and implement a public health framework for addressing gun violence

- Establish a command center in the Pennsylvania Emergency Management Agency to coordinate state and local law enforcement response

- Enhance the Joint-Local State Firearm Taskforce through additional personnel and funding to take illegal guns off the street

- Expand information gathering and sharing between all levels of law enforcement and community groups

- Increase law enforcement presence, both local and state, in targeted areas where gun violence is most prevalent

- Expedite and expand grants and other funding sources for community groups and nonprofit associations with a proven record of violence reduction and prevention

- Provide additional state resources for behavioral and mental health

- Bringing to bear the significant wealth of knowledge and experience in the Departments of Health and Human Services to provide de-escalation and de-confliction training throughout the community

- Require the Pennsylvania Department of Education provide training and professional development on trauma-informed education

View full letter →

###

HARRISBURG, PA − January 16, 2019 −Members of the Senate Democratic Caucus stood together Wednesday, outlining the impacts of the federal shutdown on their constituents and addressing potential remedies at a state level.

“In my county of Allegheny, we have about 150,000 folks who will be impacted by the change to SNAP benefits, and we want to make certain that they understand what they can do and what steps they can take during this federal shutdown,” said Senate Democratic leader Jay Costa.

“Far too many real people with real needs have been affected by a senseless federal government shutdown and are at risk of suffering through no fault of their own,” Senator Vincent Hughes said. “We want to make sure the 1.8 million Pennsylvanians who receive SNAP benefits are aware of the shutdown’s impact and have the information they need to receive services through February and beyond.”

“The federal shutdown impacts Pennsylvanians in more ways than many people appreciate,” said Senator Shariff Street. “I along with several colleagues have encouraged our financial institutions to extend resources to federal workers so that they can provide for their children, pay utility bills and continue to function during this time.”

Senator Art Haywood stated that if the federal shutdown continues, there will be no SNAP payments for the month of February.

“Make the SNAP benefits last. You will get two payments this month and are expected to have that last with no certain end date to the federal government shutdown,” said Senator Haywood. “Donald Trump said, ‘what do you have to lose?’ and now we are finding out.”

“An additional component of this federal shutdown is the effect on science, and the effect on what we rely on to keep us safe and healthy,” said Senator Daylin Leach.

Leach spoke to the fact that during the shutdown federal agencies such as the Food and Drug Administration are not doing their regular inspections of food, the Nation Oceanic and Atmospheric Administration is not tracking and publishing weather patterns, and many scientists who work for the federal government are leaving for the private sector jobs.

Also in attendance at today’s press conference were Senators Andy Dinniman, Lindsey Williams, Steve Santarsiero, Anthony Williams, Maria Collett, Tim Kearney, Wayne Fontana, Larry Farnese and Katie Muth.

For more information about Pennsylvania resources for those struggling during this shutdown of the federal government, visit pasenate.com/snap for more information.

###

Watch full press conference below.

Harrisburg – February 1, 2017 – State Senate Democrats said that Gov. Tom Wolf should call a special session of the General Assembly to ensure that legislation that results in significant property tax relief or total elimination is passed and signed into law this session.

At a news conference today at the state Capitol, Senate Democratic Leader Jay Costa (D-Allegheny) said taxpayers of Pennsylvania have waited too long for relief from escalating tax bills.

“We believe there should be a full, complete and transparent discussion of any and all tax relief or elimination proposals,” Costa said. “A special session provides the kind of platform that is needed for citizens and lawmakers to understand specifics about each proposal.”

Leading the call for the special session, state Sen. Lisa Boscola (D-Northampton) said, “Relief from property tax needs to be addressed without delay.”

In the letter to the governor, the Democrats stated, “Our taxpayers have waited far too long for action on this important issue. They want lawmakers to set aside partisan agendas and enact a significant property tax reform or elimination measure–NOW.”

Working families are struggling to pay mortgages and save for college for their children while seniors have to scrape resources together to make ends meet; property taxes add to their burden, the letter said.

Boscola, who has been a long-time advocate of property tax elimination and relief, said that “my goal is to pass legislation that will eliminate the property tax and replace it with a better system to fund public education. Our homeowners deserve it and our children need it.”

Another strong proponent of calling the special session is Senate Democratic Whip Sen. Anthony H. Williams (D-Philadelphia/Delaware).

“Addressing property tax relief or elimination needs to be a top priority, but is critical that we look at all the plans closely and find common ground,” Williams said. “A special session will force the General Assembly to focus on the issue, act assertively and come forward with a proposal that is balanced and equitable.

“Our property taxpayers have waited long enough.”

Senate Democratic Appropriations Chair Sen. Vincent J. Hughes (D-Philadelphia/Montgomery) endorsed the call for a special session.

“The issue of property taxes has been a top priority for Pennsylvanians, many of whom have seen significant tax increases over the past few years,” Hughes said. “This special session would serve as an opportunity to thoroughly examine how we can provide the sustainable property tax relief that Pennsylvanians want and deserve while ensuring that our school districts are still properly funded.”

Sen. John Blake (D-Lackawanna) said that a special session will allow lawmakers to fashion a plan that strikes a balance between property tax relief and reliable state support for public education.

“For many Pennsylvanians – particularly our seniors and lower income property owners – there is a very real school property tax crisis. I remain committed to a responsible solution that can significantly reduce and, if possible, eliminate the property tax burden on these lower income property owners,” Blake said. “I believe strongly that a special session on property tax reform can finally allow the legislature to strike the appropriate balance between property tax relief and the assurance of sufficient, predictable and reliable state financial support for public education.”

Sen. Jim Brewster (D-Allegheny/Westmoreland) said he hoped a special session will spur lawmakers to act.

“For too long our taxpayers have watched while the General Assembly has tried to deal with reducing property taxes,” Brewster said. “There are many plans now being drafted or considered and lawmakers need to come together on a plan that provided real relief or elimination. Taxpayers have waited too long.

“A special session is an excellent forum for all plans to be discussed, including the plan to totally eliminate property taxes.”

Sen. Sharif Street (D-Philadelphia) said that there are several approaches to address tax reform, but lawmakers need to be thoughtful about how tax elimination impacts schools.

“If we’re going to get serious about providing property tax relief or elimination, we must do it thoughtfully. We certainly can’t hastily approve an elimination plan at the expense of our public schools,” Street said. “There are several approaches to addressing property taxes, so a special session would provide us with a clearer path toward true relief.”

Sen. Judy Schwank (D-Berks), who has long been an advocate of property tax elimination, said school property tax is a complicated issue.

“One large source of revenue for school funding must be replaced with multiple other sources, and we must do this fairly and uniformly,” Schwank said. “Let’s use this special session to strike a balance between relieving the heavy burden property owners face, while also providing our schools with a reliable source of investment.”

Sen. Art Haywood (D-Philadelphia/Montgomery) said that property tax reform is a complex issue, but one that must be addressed.

“Property taxes remain an important issue to address. I still maintain that the appropriate solution will prove complex. We must dedicate time and effort to ensure the solution is successful,” Haywood said.

“The property tax is no longer sustainable as the sole source of funding for public education. It is high time for us to come together in the spirit of bipartisanship to develop and enact new and lasting solutions to the ongoing burden of rising property taxes on Pennsylvania homeowners,” Sen. Andy Dinniman (D-Chester) who serves as minority chair of the Senate Education Committee said. “This is a process that must involve both school districts and direct input from taxpayers and homeowners.”

The governor is empowered to call a special session of the General Assembly under the provisions of Article II, Section 4 and Article IV, Section 12 of the Pennsylvania Constitution.

-30-

Harrisburg – Oct, 20, 2015 – State Senate Democrats today called on the Pennsylvania state treasurer to “stop payment” on a scheduled disbursement of property tax revenue headed to charter schools. They have sent a letter to state Treasurer Tim Reese formally asking for the withholding of the money.

“Charter schools are seeking gaming tax relief funds based on one legal interpretation, while public schools and many public officials have a different view of the law,” state Sen. Democratic Leader Jay Costa (D-Allegheny) said today. “The treasurer should not release one dime until there is legal clarity and outstanding issues have been resolved.”

Charter schools contend that they are due disbursement from funds generated from gaming revenues. Typically, when a state budget is adopted, charter school funding is deducted from basic education subsidies.

Due to the budget impasse the normal funding stream is not available. The charters say that the law stipulates that since those funds are not available, the funds are then deducted from other state payments. The state is expected to make a $45 million payout to charter schools on Oct. 22, with 312 school districts diverting funds to charter schools.

“All of our schools, including traditional public schools and charters, need to be appropriately funded by the commonwealth,” Senate Democratic Appropriations Chair Vincent J. Hughes (D-Philadelphia/Montgomery) said. “However, we cannot provide special assistance to charter schools while many other school districts are suffering.

“I urge the state treasurer to hold off making payments to charter schools until the budget impasse has been resolved and all schools have funding in place.”

Sen. Jim Brewster (D-Allegheny/Westmoreland) called for the suspension of the payment to charter schools late last week. Brewster said “public schools are facing incredible difficulties because of the lack of a state budget.

“Now, the funding they are getting outside of the basic subsidy is being hijacked and that is wrong.”

Brewster pointed to the situation involving two of his school districts in the Monongahela Valley as examples of inequity. He said that while McKeesport is due $1.2 million in reimbursements, they will only receive $41,000 after charter school funds are deducted. He said that Clairton will have to send its entire $230,000 reimbursement to charters and receive nothing.

“Since so many of our schools are hurting due to the budget impasse, we need to answer important legal questions regarding these funds before they are distributed later,” Sen. Andy Dinniman (D-Chester), Democratic chair of the Senate Education Committee, said. “The bottom line is that both public and charter schools are in need of these supplemental gaming funds – funds that do not go through the normal budget process.”

In the letter to the treasurer, Senate Democrats said they do not believe that gaming fund reimbursements constitute “state payments” and that the state law dealing with disbursement of funds never contemplated a budget impasse.

They say that the statute involving the generation of faming funds and property tax relief define the use of funds disbursed from the property tax relief fund. Senate Democrats say that there is no discretion to shift funds earmarked for tax relief to pay operational costs at charter schools.

“Pennsylvania Race Horse Development and Gaming Act and the Taxpayer Relief Act must be read together in order to establish the General Assembly’s intent for the use of the money in the Property Tax Relief Fund,” the letter says.

Costa said that under the Fiscal Code the state treasurer has the authority to withhold payments from the state treasury.

“No payment can be made without the state treasurer’s warrant and approval,” Costa said. “This is a clear case when the law is murky and public schools are being treated inequitably by laws that did not anticipate a long budget impasse.”

Brewster, who met with the secretary of education and budget secretary yesterday about the issue, said he is very concerned about the short-term financial health of school districts if the funds are diverted.

“Many school districts across the state will bear the burden if these funds are released and they are not compensated,” Brewster said. “Given the outstanding legal issues, the responsible course of action is to stop payment until the conflicting interpretations of the law are reconciled.”

-30-

Harrisburg, June 18, 2015 − Senate Democratic Leader Jay Costa (D-Allegheny), Sens. Andy Dinniman (D-Chester) and Rob Teplitz (D-Dauphin/Perry) who serve as members of the Basic Education Funding Commission (BEFC) today hailed the new proposed statewide education funding formula as a responsible, predicable and equitable approach that would improve education for all students.

The formula, which the commission is recommending to be used to distribute basic education funding from the state to local school districts, was unveiled and unanimously adopted at a commission meeting this morning in Harrisburg. The proposal still has to be approved by the General Assembly.

The senators said the plan would address the wide inequity in education resources that hold back students from the poorest districts.

The formula contains five factors that reflect the actual costs of educating children in various economic circumstances: poverty, poverty concentration, English language learners, charter school enrollment, and district size. Local tax effort and tax capacity are also included, as is a determination of relative wealth of a district based on median income.

Pennsylvania is only one of three states that have no funding formula for public schools and has the distinction of having the most inequitable spending for poor students in the country.

The commission did exemplary work in crafting a new funding formula that is meaningful and substantive, Costa said. The commission was able to cut through politics, regional bias and complex issues to produce a funding structure that, if fully funded, will help students, parents, teachers, administrators and taxpayers.

Dinniman said he is pleased with the new funding formula but its success is totally dependent on the General Assembly providing sufficient dollars to ensure that all students have an equal opportunity to be educated to the top of the curriculum.

The goal is to improve performance statewide and eliminate funding disparities that plague student development by removing funding impediments so state funding is equitably distributed, said Dinniman, who serves as the Senate Democratic Education Chair, said. For too long, Pennsylvania school children and taxpayers have had to overcome funding challenges which were created in Harrisburg.

The new funding formula will rectify the imbalance and equitably spread funding.

Teplitz, who is a member of the Senate Education and Appropriations committees, praised the commissions process of developing a fair formula that was crafted in a bipartisan, open, and inclusive way. Its equally important to ensure that basic education is also properly funded, he said.

The formula that was developed by the commission on a bipartisan basis addresses funding equity, but we also must ensure that our schools are also adequately funded. If we want all kids to have access to a quality public education, we must not only divide up the pie more fairly, but also increase the size of the pie itself, said Teplitz. Being a member of this commission was a tremendous experience and I look forward to continuing to fight for our children.

Recognizing the need to develop a predictable, fair, and equitable education funding formula, the General Assembly passed Act 51 in 2014 that created the commission. BEFC has 15 members, including 12 legislative appointees and 3 cabinet officials. Costa, Teplitz and Dinniman are the current Democratic appointees. Sen. Matt Smith (D-Allegheny) served as a member of the committee until his announced departure from the Senate.

The senators said the formula represents a fair and equitable way to disburse education dollars for funding public education. The poorest 25 percent of districts will be getting an average of four times more from the formula than the richest 25 percent of districts.

Costa said because the formula was developed on a bipartisan basis with input from the administration, he was hopeful that the formula would be supported by increased education funding in the upcoming state budget.

-30-

Contact: Stacey Witalec

Telephone: 717 877-2997

Email: switalec@pasenate.com