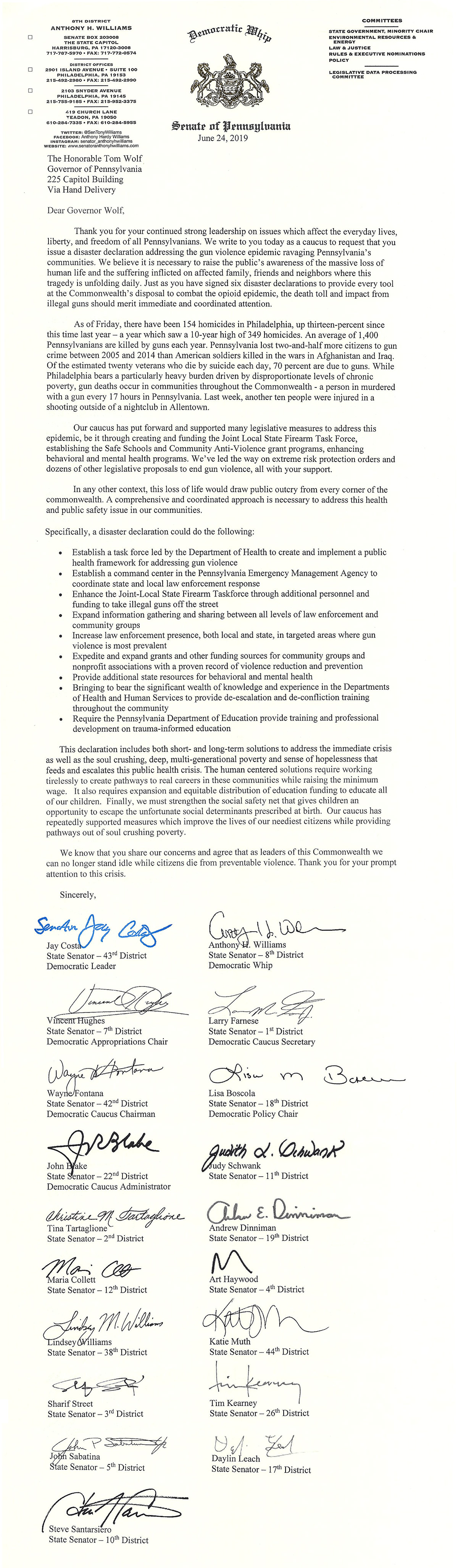

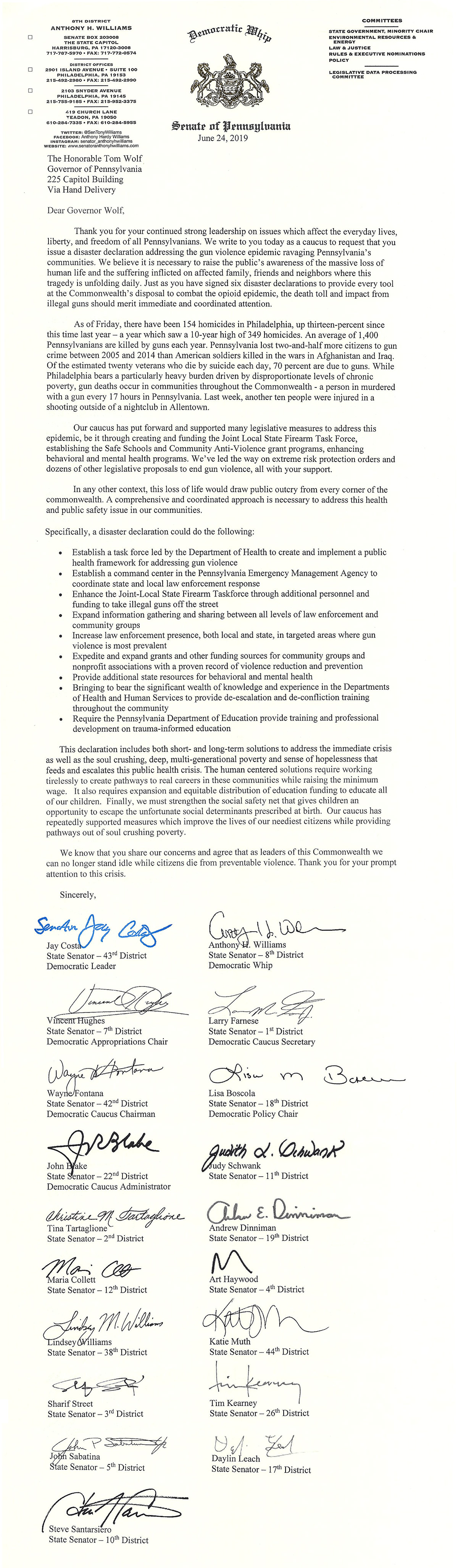

Harrisburg, Pa. − June 24, 2019 − Members of the Pennsylvania Senate Democratic Caucus today jointly sent a letter to Governor Tom Wolf requesting a disaster declaration for gun violence in the Commonwealth.

“We believe it is necessary to raise the public’s awareness of the massive loss of human life and the suffering inflicted on affected family, friends and neighbors where this tragedy is unfolding daily,” they wrote. “Just as you have signed six disaster declarations to provide every tool at the Commonwealth’s disposal to combat the opioid epidemic, the death toll and impact from illegal guns should merit immediate and coordinated attention.”

Specifically, a disaster declaration could do the following:

- Establish a task force led by the Department of Health to create and implement a public health framework for addressing gun violence

- Establish a command center in the Pennsylvania Emergency Management Agency to coordinate state and local law enforcement response

- Enhance the Joint-Local State Firearm Taskforce through additional personnel and funding to take illegal guns off the street

- Expand information gathering and sharing between all levels of law enforcement and community groups

- Increase law enforcement presence, both local and state, in targeted areas where gun violence is most prevalent

- Expedite and expand grants and other funding sources for community groups and nonprofit associations with a proven record of violence reduction and prevention

- Provide additional state resources for behavioral and mental health

- Bringing to bear the significant wealth of knowledge and experience in the Departments of Health and Human Services to provide de-escalation and de-confliction training throughout the community

- Require the Pennsylvania Department of Education provide training and professional development on trauma-informed education

View full letter →

###

Harrisburg – February 1, 2017 – State Senate Democrats said that Gov. Tom Wolf should call a special session of the General Assembly to ensure that legislation that results in significant property tax relief or total elimination is passed and signed into law this session.

At a news conference today at the state Capitol, Senate Democratic Leader Jay Costa (D-Allegheny) said taxpayers of Pennsylvania have waited too long for relief from escalating tax bills.

“We believe there should be a full, complete and transparent discussion of any and all tax relief or elimination proposals,” Costa said. “A special session provides the kind of platform that is needed for citizens and lawmakers to understand specifics about each proposal.”

Leading the call for the special session, state Sen. Lisa Boscola (D-Northampton) said, “Relief from property tax needs to be addressed without delay.”

In the letter to the governor, the Democrats stated, “Our taxpayers have waited far too long for action on this important issue. They want lawmakers to set aside partisan agendas and enact a significant property tax reform or elimination measure–NOW.”

Working families are struggling to pay mortgages and save for college for their children while seniors have to scrape resources together to make ends meet; property taxes add to their burden, the letter said.

Boscola, who has been a long-time advocate of property tax elimination and relief, said that “my goal is to pass legislation that will eliminate the property tax and replace it with a better system to fund public education. Our homeowners deserve it and our children need it.”

Another strong proponent of calling the special session is Senate Democratic Whip Sen. Anthony H. Williams (D-Philadelphia/Delaware).

“Addressing property tax relief or elimination needs to be a top priority, but is critical that we look at all the plans closely and find common ground,” Williams said. “A special session will force the General Assembly to focus on the issue, act assertively and come forward with a proposal that is balanced and equitable.

“Our property taxpayers have waited long enough.”

Senate Democratic Appropriations Chair Sen. Vincent J. Hughes (D-Philadelphia/Montgomery) endorsed the call for a special session.

“The issue of property taxes has been a top priority for Pennsylvanians, many of whom have seen significant tax increases over the past few years,” Hughes said. “This special session would serve as an opportunity to thoroughly examine how we can provide the sustainable property tax relief that Pennsylvanians want and deserve while ensuring that our school districts are still properly funded.”

Sen. John Blake (D-Lackawanna) said that a special session will allow lawmakers to fashion a plan that strikes a balance between property tax relief and reliable state support for public education.

“For many Pennsylvanians – particularly our seniors and lower income property owners – there is a very real school property tax crisis. I remain committed to a responsible solution that can significantly reduce and, if possible, eliminate the property tax burden on these lower income property owners,” Blake said. “I believe strongly that a special session on property tax reform can finally allow the legislature to strike the appropriate balance between property tax relief and the assurance of sufficient, predictable and reliable state financial support for public education.”

Sen. Jim Brewster (D-Allegheny/Westmoreland) said he hoped a special session will spur lawmakers to act.

“For too long our taxpayers have watched while the General Assembly has tried to deal with reducing property taxes,” Brewster said. “There are many plans now being drafted or considered and lawmakers need to come together on a plan that provided real relief or elimination. Taxpayers have waited too long.

“A special session is an excellent forum for all plans to be discussed, including the plan to totally eliminate property taxes.”

Sen. Sharif Street (D-Philadelphia) said that there are several approaches to address tax reform, but lawmakers need to be thoughtful about how tax elimination impacts schools.

“If we’re going to get serious about providing property tax relief or elimination, we must do it thoughtfully. We certainly can’t hastily approve an elimination plan at the expense of our public schools,” Street said. “There are several approaches to addressing property taxes, so a special session would provide us with a clearer path toward true relief.”

Sen. Judy Schwank (D-Berks), who has long been an advocate of property tax elimination, said school property tax is a complicated issue.

“One large source of revenue for school funding must be replaced with multiple other sources, and we must do this fairly and uniformly,” Schwank said. “Let’s use this special session to strike a balance between relieving the heavy burden property owners face, while also providing our schools with a reliable source of investment.”

Sen. Art Haywood (D-Philadelphia/Montgomery) said that property tax reform is a complex issue, but one that must be addressed.

“Property taxes remain an important issue to address. I still maintain that the appropriate solution will prove complex. We must dedicate time and effort to ensure the solution is successful,” Haywood said.

“The property tax is no longer sustainable as the sole source of funding for public education. It is high time for us to come together in the spirit of bipartisanship to develop and enact new and lasting solutions to the ongoing burden of rising property taxes on Pennsylvania homeowners,” Sen. Andy Dinniman (D-Chester) who serves as minority chair of the Senate Education Committee said. “This is a process that must involve both school districts and direct input from taxpayers and homeowners.”

The governor is empowered to call a special session of the General Assembly under the provisions of Article II, Section 4 and Article IV, Section 12 of the Pennsylvania Constitution.

-30-

Wilkinsburg, August 4, 2016 – At the request of state Senate Democratic Leader Jay Costa, a joint state Senate-House Democratic Policy Committee hearing was held today on efforts and resources to fight blight within our communities, including the successes and challenges of land banks.

“Blight is a scourge that impedes both business and residential interest in a community,” Costa said. “We must do what we can to give our municipalities the resources, tools and flexibility they need to quickly eradicate blight and begin revitalization efforts.”

Costa said blight poses health and safety risks, reduces neighborhood property values, drains municipal revenue on enforcement and maintenance efforts, and discourages community investment and growth.

Sen. Lisa Boscola (D-Northampton), who chairs the Senate Democratic Policy Committee, said “transforming dilapidated properties from community liabilities to revitalization linchpins must be our shared goal.”

Boscola added that Pennsylvania has approximately 300,000 vacant properties – many of them eye-sores. She said legislators should steer clear of “one-size-fits-all solutions” and give local government leaders the “flexibility to tailor revitalization efforts that fit their unique needs.”

State Rep. Ed Gainey (D-Allegheny), who co-chaired the hearing, said the state has passed several laws in recent years aimed at assisting local governments in blight removal and revitalization initiatives. He added that there are also numerous proposals under consideration in the legislature that would generate more funding for demolition and revitalization work and toughen penalties against absentee owners.

Costa said a 2012 law that established land banks provides an innovative way to acquire and ready properties for reinvestment. He pointed to the local Tri-COG Land Bank as a “promising program that numerous Allegheny county communities should look into.” Tri-COG recently received a pledge of $1.5 million in seed funding from the Heinz endowment.

A land bank acquires blighted properties, clears delinquent taxes and liens, and prepares the property for investment and revitalization – all aimed at returning the property to the tax rolls and productive use. A county or municipality must have a population of at least 10,000 to form a land bank. Local governments have the option of joining and must pay 5 percent of yearly delinquent tax collections to help fund the program.

Urban Redevelopment Authority Director Kyra Straussman lamented that a fourth of the city’s footprint is abandoned and vacant property that the government does not control.

“While our tax base is eroding, we are simultaneously directly paying millions in tax dollars annually to keep problem vacant and abandoned property just as it is,” she said.

Matt Madia, who serves as chief strategy and development officer for Bridgestone Capital investment program, discussed his firm’s revitalization work, including its $9.6 million effort to revitalize the Homewood neighborhood in Pittsburgh. He said some of their business loans have resulted in new businesses occupying commercial space that would otherwise be vacant. He said providing this core business sector with its products and services helps make a neighborhood “welcoming and livable.”

Mark Mohn, vice-chair state Association of Realtors Legislative Committee, said rising property local taxes has worsened the blight problem by making home ownership less affordable. He said lawmakers should consider shifting the tax burden away from homeowners to more broad-based local and state resources.

“It’s time to stop picking the pockets of homebuyers,” Mohn added, suggesting that lawmakers should consider allowing bond referendums and Social Impact Bonds where municipalities can pay back outside investors for transforming blighted properties into productive ones.

Others who testified were: Cynthia Whitman Daley, policy director of the PA Housing Alliance; Tracey Evans, executive director of the Wilkinsburg Community Development Corporation; A. William Schenck, TriState Capital Bank Board Member, Pennsylvania Economy League of Greater Pittsburgh; An Lewis, Director, Steel Rivers COG; Daniel Lavelle, board member, Pittsburg Land Bank; and Liz Kozub, Community Development coordinator, Turtle Creek COG.

Joining Costa, Gainey and Boscola were Senators John Blake (D-Lackawanna), Jim Brewster (D-Allegheny/Westmoreland), Wayne Fontana (D-Allegheny), and Representatives Chris Sainato (D-Lawrence) and Paul Costa (D-Allegheny).

# # #

Harrisburg, May 18, 2016 – With drug overdose deaths reaching epidemic levels, Senate Democrats unveiled legislation today to address the opioid addiction crisis from prevention through recovery.

“Addiction is a disease that does not discriminate and there is no easy solution to fix the problem,” Senate Democratic Leader Jay Costa (D-Allegheny) said. “When addiction finds its way into a family, it can nearly paralyze them for fear of what the future may hold.”

Recognizing the need to provide support at all levels, the Senate Democrats’ legislation focuses on providing new opportunities for education and treatment as well as expanded support options in the community for addicts, professionals and families.

“We cannot address this problem in a vacuum and must work to provide the necessary services and support to everyone involved,” Costa said. “Families are being affected and communities torn apart as a result of opioid abuses and heroin addiction.”

Opioids are a class of drug that include heroin as well as the prescription pain relievers oxycodone, hydrocodone, codeine, morphine, fentanyl and others. According to a University of Pittsburgh Graduate School of Public Health study, fatal drug overdoses in Pennsylvania increased 14 fold between 1979 and 2014.

“We are in the midst of the worst ever overdose death epidemic and the worst public health crisis of the last 100 years, Secretary of Drug and Alcohol Programs Gary Tennis said. “It will continue to take a collaborative effort among many partners to effectively address this crisis.”

The package of legislation includes:

Emergency Addiction Treatment Program – Charging the Department of Drug and Alcohol Programs with establishing a comprehensive program that includes new addiction treatment facilities for those drug users that are currently going without care; new intake methods to provide information to those with addiction problems or their family and friends; advice and assistance in accessing treatment; and data collection to help identify patterns of addiction.

School Aged Children Opioid Awareness Education Program – Requiring the Departments of Drug and Alcohol Programs, Health, and Education to work cooperatively to design an opioid awareness education programs to be delivered in schools.

Addiction Treatment Professional Loan Forgiveness Program – Require the Pennsylvania Higher Education Assistance Agency (PHEAA) to develop an addiction treatment professional loan forgiveness program.

Opioid Addiction Prevention and Treatment Assessment – Impose a 10 percent assessment on the first sale of an opioid into the state. Revenues from the assessment will be used to support the purchase of naloxone for local law enforcement and emergency management personnel in addition to supporting addiction prevention and treatment programs.

Responding to the Senate Democratic proposals to the drug and alcohol problem, Deb Beck from the Drug and Alcohol Service Providers Organization of Pennsylvania said that the drug and alcohol problem “has reached epidemic levels in the state and these proposals will be life saving in impact.”

###

HARRISBURG, March 12, 2014 – State Senate Democrats today said they would save Pennsylvania taxpayers billions of dollars and solve the state’s pension problem if their proposal to further reform pension rules, refinance billions and help school districts avoid escalating payments is adopted.

Senate Democratic Leader Jay Costa (D-Allegheny); the Democratic chairman of the Senate Finance Committee, Sen. John Blake (D-Lackawanna), Senate Whip Anthony H. Williams (D-Philadelphia); the Democratic chairman of the Senate Appropriations Committee, Sen. Vince Hughes (D-Philadelphia); and Sen. Larry Farnese (D-Philadelphia) unveiled the caucus’ proposal during a briefing with Capitol news correspondents.

With the State Employees’ Retirement System and the Public School Employees’ Retirement System drowning in a sea of underfunding approaching $50 billion, the Senate Democratic proposal would refinance $9 billion of that, further reform the state pension law to stop charter schools from receiving double-dip state reimbursements, and lower the collars on state and school district payments to provide short-term budget relief while also making it easier to manage future cost increases.

“The pension reform plan we are suggesting is smart and innovative. It saves money and creates a plausible responsible fiscal roadmap for the future,” Sen. Costa said. “Refinancing $9 billion in existing unfunded liabilities would decrease long-term payments by $24 billion. Over the next five years, it would save school districts $600 million and the commonwealth $1 billion.”

The Democratic Senators said they are making this proposal because it would avoid the dangers posed by Gov. Tom Corbett’s pension proposal, such as:

- $2 billion in additional payments over the next four years, including $550 million more in the 2015-’16 state budget

- $5 billion more in unfunded pension liabilities, and

- The camouflaging of increased future costs that could add millions more to the pension crisis.

Sen. Blake repeated the Democratic Caucus’ mantra that time is of the essence for these critical changes to happen.

“If we continue to delay our responsibility to fulfill our fiduciary requirement and deliver what has been promised in retirement to thousands of educators and public employees, it will be taxpayers, their children, and their children’s children who will have to pay the bill,” Blake said. “We cannot allow that to happen.

“The Corbett administration has already refinanced billions in debt to make a bad situation better when it floated nearly $4 billion in bonds to restore Pennsylvania’s unemployment compensation reserves in 2012. We must do the same with pensions,” the Lackawanna County Democrat said.

Senate Democratic Appropriations Chairman Vince Hughes urged bipartisan support for the caucus’ proposal.

“People from across the political spectrum are, and have been, educators and state employees. They are depending on us to fix this growing problem and this is the solution we need,” Hughes said. “Republicans and Democrats in the General Assembly must work together to get this idea to the governor’s desk.”

Sen. Williams said he believes fiscally responsible lawmakers will especially like the proposal to eliminate the current practice that allows charter schools be reimbursed by the state for pension payments that are completely paid for by school districts.

“This has been a good deal for charter schools, but the set up is hurting school districts, taxpayers and students across the state,” Williams said. “Making this change will significantly reduce school district pension payments because it will eliminate the 50 percent reimbursement that charter schools now receive after districts pay the escalating pension bill.”

And, Sen. Farnese said it is important for the commonwealth to continue its defined benefits pension system because it requires financial professionals to manage contributions.

“Too many people who are approaching retirement don’t have the nest eggs to guarantee them the security and independence they need to do the things they dreamed of doing when they were working,” Farnese said. “Defined benefit pensions are still the most efficient way to save for retirement. Moving away from that system will only hurt the financial security of future generations.”

The National Bureau of Economic Research in Cambridge, Mass., issued a report in February indicating that half of the households where people are on the cusp of retirement (65 to 69 years old) have retirement accounts of $5,000 or less.

-30-